Tax Refund

At present, Beijing, Shanghai, Tianjin, Shenzhen, Qingdao, Jiangsu Province, Hebei Province, Shaanxi Province, Yunnan Province, Anhui Province, Sichuan Province, Liaoning Province, Fujian Province, Hainan Province as well as Harbin, Heihe, Suifenhe in Heilongjiang Province and Nanning, Guilin, Fangchenggang in Guangxi have adopted a tax refund policy among overseas, Hong Kong, Macau, and Taiwan tourists. Visitors who have bought products at tax free stores in China can withdraw value added tax (VAT) before leaving. It's expected that in the near future the policy will come into effect in more and more China regions.

1. Overseas/Hong Kong/Macau/Taiwan visitors should stay in Mainland China for no more than 183 days consecutively to qualify for the tax rebate policy.

1. Overseas/Hong Kong/Macau/Taiwan visitors should stay in Mainland China for no more than 183 days consecutively to qualify for the tax rebate policy.

2. The purchased goods should be for personal use and not prohibited to be taken out of Mainland China.

2. The purchased goods should be for personal use and not prohibited to be taken out of Mainland China.

See detailed Exit Regulations of China.

See detailed Exit Regulations of China.

3. A minimum of CNY 500 shall be spent in one designated tax free store during any one day by one tourist.

3. A minimum of CNY 500 shall be spent in one designated tax free store during any one day by one tourist.

4. The visitor shall exit from designated ports and ensure that the goods are brand new and unused. At present, the designated ports mainly include airports and cruise ports, like Beijing Capital International Airport, Shanghai Pudong International Airport, and Tianjin Binhai International Airport.

4. The visitor shall exit from designated ports and ensure that the goods are brand new and unused. At present, the designated ports mainly include airports and cruise ports, like Beijing Capital International Airport, Shanghai Pudong International Airport, and Tianjin Binhai International Airport.

5. The time span between the purchase date and the departure date shall be less than 90 days.

5. The time span between the purchase date and the departure date shall be less than 90 days.

6. The purchased goods must leave China along with the visitor.

6. The purchased goods must leave China along with the visitor.

Currently, there are over 1,000 designated tax free stores in Beijing, over 700 in Shanghai, over 400 in Chengdu of Sichuan, over 400 in Shenzhen, 34 in Tianjin, 33 in Qingdao, 21 in Xiamen of Fujian, 9 in Qinhuangdao of Hebei, 8 in Haikou and 5 in Sanya ... They cover the major shopping malls, tourist shopping centers, and residence areas of foreigners. Here is a list of some:

In Beijing: Gongmei Group, Wangfujing Department Store, Dong'an Department Store, and Wuyutai Tea Shop on Wangfujing Street; Huayuan Shopping Center, Pacific Department Store, and Hanguang Shopping Mall on Xidan Commercial Street…

In Beijing: Gongmei Group, Wangfujing Department Store, Dong'an Department Store, and Wuyutai Tea Shop on Wangfujing Street; Huayuan Shopping Center, Pacific Department Store, and Hanguang Shopping Mall on Xidan Commercial Street…

In Shanghai: Shanghai New World Co., Ltd, Maochang Optical, and Heng Da Li Watch Flagship Store on Nanjing Road; Huabao Pavilion and Tianyu Pavilion around Yuyuan Garden…

In Shanghai: Shanghai New World Co., Ltd, Maochang Optical, and Heng Da Li Watch Flagship Store on Nanjing Road; Huabao Pavilion and Tianyu Pavilion around Yuyuan Garden…

In Xi'an: Kaiyuan Shopping Center, Parkson Shopping Center, Century Ginwa Shopping Plaza near the Bell Tower...

In Xi'an: Kaiyuan Shopping Center, Parkson Shopping Center, Century Ginwa Shopping Plaza near the Bell Tower...

In Tianjin: Yangliuqing Painting Store, Binjiang Shopping Center, Guorenzhang Nuts Store...

In Tianjin: Yangliuqing Painting Store, Binjiang Shopping Center, Guorenzhang Nuts Store...

In Chengdu of Sichuan: Renhe Spring Department Store, International Finance Square...

In Chengdu of Sichuan: Renhe Spring Department Store, International Finance Square...

In Haikou: S&S Department Store, Minsheng Department Store

In Haikou: S&S Department Store, Minsheng Department Store

In Sanya: Yifang Shopping Center, Sanya International Shopping Center, Summer Mall

In Sanya: Yifang Shopping Center, Sanya International Shopping Center, Summer Mall

The refund rate is 11% of the invoice value. However, 2% of the rebates are charged by the rebate agency as service fee. Therefore, visitors actually enjoy a rebate rate of 9%.

The refund rate is 11% of the invoice value. However, 2% of the rebates are charged by the rebate agency as service fee. Therefore, visitors actually enjoy a rebate rate of 9%.

Refunds = Invoice Value (VAT included) x Rebate Rate (11% - 2%)

For instance, if one spends CNY 1000 in a store, CNY 90 (CNY 1000 x 9%) will be returned.

The rebates will be given in CNY. If the amount is not beyond CNY 10,000, both cash and bank transfer rebates are allowed. Otherwise, if the amount exceeds CNY 10,000, only bank transfer is allowed.

1. Purchase goods in designated stores with the "Tax Free" sign. Ask for the sales invoice and tax refund form from the clerk.

1. Purchase goods in designated stores with the "Tax Free" sign. Ask for the sales invoice and tax refund form from the clerk.

2. Visit the customs office at the departure port and present the refund form, invoice, passport or ID card as well as the purchased products. If nothing goes wrong, the officer will stamp on the refund form.

2. Visit the customs office at the departure port and present the refund form, invoice, passport or ID card as well as the purchased products. If nothing goes wrong, the officer will stamp on the refund form.

3. After, go through the joint inspection, head to the refund counter, have the materials examined and have the rebates back.

3. After, go through the joint inspection, head to the refund counter, have the materials examined and have the rebates back.

Note: Under the condition that all necessary materials are prepared, it takes three to five minutes at the customs office and refund desk respectively. On average, it takes a visitor about 15 minutes to go through all the formalities. However, it's strongly recommended to spare additional 40 minutes to an hour for the whole process.

Note: Under the condition that all necessary materials are prepared, it takes three to five minutes at the customs office and refund desk respectively. On average, it takes a visitor about 15 minutes to go through all the formalities. However, it's strongly recommended to spare additional 40 minutes to an hour for the whole process.

Location for Custom Verification and Refund at Main Exit Ports

Location for Custom Verification and Refund at Main Exit Ports

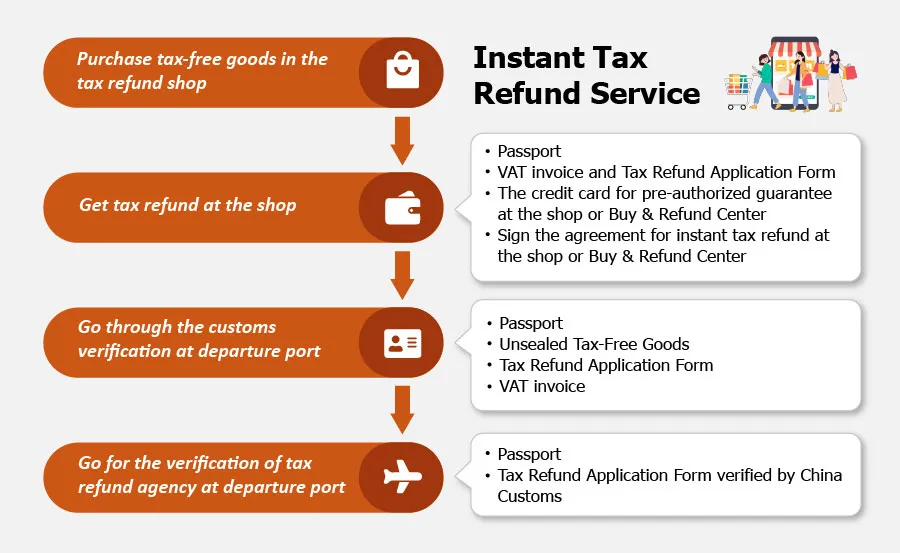

Instant tax refund enables overseas travelers to receive tax refund on-site after purchase, rather than apply for a refund at the airport or port when leaving. The policy has been piloted in Shanghai, Beijing, Guangdong, Sichuan, Zhejiang and Shenzhen, and has been welcomed by overseas travelers, thus it is extended to the whole country successively.

Step One: Receive Tax Refund On-site.

Step One: Receive Tax Refund On-site.

While tourists making purchase at designated tax-free shops, the shops will issue VAT invoice and the Tax Refund Application Form to tourists. After, tourists need to sign the agreement for "instant tax refund" at the shops or the Buy & Refund Center and complete a credit card pre-authorization with the help of the shops or the center. Tourists will then receive the pre-paid tax refund immediately which can be used for further purchase.

Note: Tourists are supposed to hold a credit card ready for pre-authorization guarantee.

Step Two: Go through the Customs Verification

Step Two: Go through the Customs Verification

When leaving the country, tourists should declare to the customs and undergo the customs verification with the tax rebate items, his or her passport, VAT invoice, and Tax Refund Form.

Step Three: Refund Agencies Verify and Lift the Pre-authorization

Step Three: Refund Agencies Verify and Lift the Pre-authorization

At the departure port, tourists shall go to the refund agency after customs check with tax refund application form verified by China Customs. The refund agencies will confirm that the tourist is eligible for the instant tax refund in accordance with the agreement and then release the credit card pre-authorization. And the pre-paid refund will then be the final tax refund.

Notably, if it happens that the tourist does not qualify for the instant tax refund, for example, the tourist don’t leave within the specified time written in the agreement which has been signed at tax-free shops, the tax refund agency will charge the traveler’s credit card.

|

| Tax Refund Process |

Conditions for Using the Policy

Currently, there are over 1,000 designated tax free stores in Beijing, over 700 in Shanghai, over 400 in Chengdu of Sichuan, over 400 in Shenzhen, 34 in Tianjin, 33 in Qingdao, 21 in Xiamen of Fujian, 9 in Qinhuangdao of Hebei, 8 in Haikou and 5 in Sanya ... They cover the major shopping malls, tourist shopping centers, and residence areas of foreigners. Here is a list of some:

|

|

Tax Refund Rate

Refunds = Invoice Value (VAT included) x Rebate Rate (11% - 2%)

For instance, if one spends CNY 1000 in a store, CNY 90 (CNY 1000 x 9%) will be returned.

The rebates will be given in CNY. If the amount is not beyond CNY 10,000, both cash and bank transfer rebates are allowed. Otherwise, if the amount exceeds CNY 10,000, only bank transfer is allowed.

How to Apply for Rebates

| Designated Exit Ports | Check Points of Customs | Location of Refund Counter |

|---|---|---|

| Beijing Capital International Airport | 2F, International Departure Zone, T2 Zone C, 2F, T3 (check-in items); Zone E, 2F, T3 (carry-on items) | T-mouth, 2F, International Departure Zone, T2; Zone E, 2F, T3 |

| Shanghai Pudong International Airport | Gate 10, International Departure Hall, T1; Gate 25, International Departure Hall, T2 | Separate Zone for international departures |

| Shanghai Hongqiao International Airport | Gate 6, International Departure Hall, T1 | Separate Zone for international departures |

| Shenzhen Bao'an International Airport | Customs Surveillance Zone, Departure Hall, Terminal T3 Floor 3 | See the signpost inside the Isolated Area of Terminal T3 |

| Chengdu Shuangliu International Airport | Left of International Entry/Exit Passage, International Departure Zone, T1 | Boarding Gate 102, International Departure Zone, T1 |

| Qingdao Liuting International Airport | Near the entrance of the Separate Zone for international departures (check-in items); Boarding Gate 8, Separate Zone for international departures (carry-on items) | Boarding Gate 8, Separate Zone for international departures |

| Tianjin Binhai International Airport | International Departure Hall, T1 | Separate Zone for international departures |

Instant Tax Refund in China for Overseas Tourists

How Instant Tax Refund Works

|

While tourists making purchase at designated tax-free shops, the shops will issue VAT invoice and the Tax Refund Application Form to tourists. After, tourists need to sign the agreement for "instant tax refund" at the shops or the Buy & Refund Center and complete a credit card pre-authorization with the help of the shops or the center. Tourists will then receive the pre-paid tax refund immediately which can be used for further purchase.

Note: Tourists are supposed to hold a credit card ready for pre-authorization guarantee.

When leaving the country, tourists should declare to the customs and undergo the customs verification with the tax rebate items, his or her passport, VAT invoice, and Tax Refund Form.

At the departure port, tourists shall go to the refund agency after customs check with tax refund application form verified by China Customs. The refund agencies will confirm that the tourist is eligible for the instant tax refund in accordance with the agreement and then release the credit card pre-authorization. And the pre-paid refund will then be the final tax refund.

Notably, if it happens that the tourist does not qualify for the instant tax refund, for example, the tourist don’t leave within the specified time written in the agreement which has been signed at tax-free shops, the tax refund agency will charge the traveler’s credit card.

- Last updated on Apr. 11, 2025 by Gabby Li -